Life Insurance Corporation of India Policy Loan Options

Table of Content

- What is the current rate of interest in LIC HFL?

- LIC Housing Finance Loan Status

- Apply For Home Loan

- How to check LIC policy status online?

- How to Check Your LIC Housing Finance Home Loan Approval Status Online

- What is the interest rate for LIC policy loan?

- What are LIC HFL login services?

- Can we skip home loan EMI for few months?

LIC’s Griha Suvidha Home loan is a mortgage-backed housing loan that allows people to buy their dream house. People are eligible for subsidies on this loan under the Pradhan Mantri Awas Yojana – Credit Linked Subsidy Scheme. LIC home loans can last for 30 years or attainment of 60 years, whichever is earlier. Click on ‘Go’ and your statement will be generated. Enter your loan/application number and your date of birth. We'll ensure you're the very first to know the moment rates change.

In the next page, Kindly verify the uploaded documents by clicking on view documents. Click on Upload.An alert will pop-up that documents are uploaded successfully. Easy access to LICHFL Agents for submitting application. What is the maximum loan amount that I can get through NRI Home Loan? A person can get maximum 90% funding if the loan amount is Rs. 30 lakhs, 80% up to Rs. 75 lakhs and 75% for loan amounts above Rs. LIC Housing Finance Limited is one of the largest Housing Finance Mortgage loan companies in India having its Registered and Corporate office at Mumbai.

What is the current rate of interest in LIC HFL?

A home loan sanction letter is an official document issued by a lending organisation to customers stating that their loan is approved. The lender issues the sanction letter after verifying the home loan applicant’s details such as credit history, income, repayment capacity etc. The user’s SMS-based helpline service is another method to verify your insurance status on the move.

This is the maximum amount that the borrowing company can utilize. For each missed EMI payment, you will be required to pay late fees, penalties, and penal interest. The penalties are usually 1% to 2% on the overdue amount. The penal interest is charged over and above the regular interest in your home loan .

LIC Housing Finance Loan Status

You can track your home loan application online as well as offline. To track the application, you will need to provide your application /reference number, date of birth and mobile number. No matter where you are, you can track your home loan application at any time using your mobile number and date of birth.

If you are an existing customer of the bank, you can easily track your application through net banking. There are three different ways you can track your home loan application. If you are a new user kindly register into customer portal by following New user registration guidelines. 9) You have successfully registered into customer portal and You can login through Login Page with your credentials. To calculate the monthly payment on an interest only loan, simply multiply the loan balance times the monthly interest rate. The monthly interest rate is the annual interest rate divided by twelve.

Apply For Home Loan

LIC HFL is a subsidiary company of LIC….LIC Housing Finance. The starting basic pay is Rs. 32,815/- per month. Payscale of LIC HFL Assistant Manager is – 1685 –56405 – 1755 – with all other admissible allowances as per rules. You can avail loan if you can complete your house construction in 3 years from the date of purchase. You can use 60% of the loan amount to buy the plot, but the other 40% should be used to construct your house.

When it comes to loan eligibility, you will often find that LICHFL favours the borrower and approves a higher loan amount than most lenders. Address proof such as Aadhar, Passport, Driving license, electricity bill, ration card, bank statement, etc. You can also walk in to any nearest branch of the lender. You will have to share your application ID or reference number with the officer in-charge of the credit department to know the status of your application. You can call your lender’s customer care department to know the status of your application. You will have to share your application ID or reference number with the customer care representative to know the status.

Your loan will be age-restricted up to the age of retirement for loan calculation. If you are a primary borrower, your income should be at least 30,000 rupees monthly. However, if you apply for the joint borrower, your income should be 40,000 rupees monthly. A loan statement has all of the details of your current loan and gives our team the information we need to pay off that loan.

When you submit your application, the bank issues a reference number or application number. You can use that number also to track your home loan application. For viewing the policy-related information, new customers are required to go through a Registration procedure, the details of which are stated in the ensuing paragraph. LIC offers around 10-12\% interest rate for a loan against their policy. The loan against LIC Policy is disbursed comparatively faster as there is no complicated paperwork required. An individual can get the loan amount within a period of just 3-5 days.

Click on “Download Repay Certificate” to get the certificate downloaded. Select the “Repay Certificate” link on the left hand side. As the largest platform for buyers and sellers of property to connect in a transparent manner, Magicbricks has an active base of over 15 lakh property listings. You can avail of the loan from LIC itself, or you can also borrow from other banks.

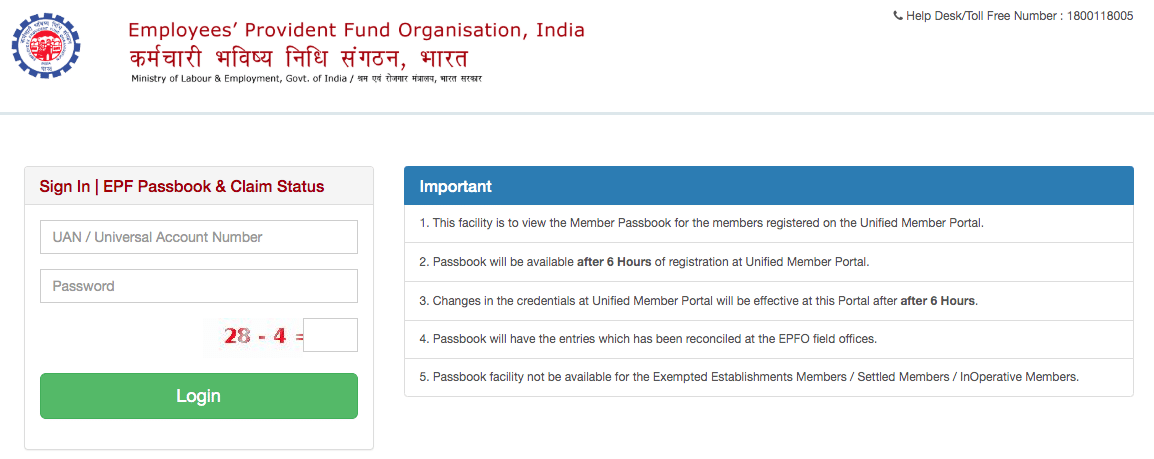

To sign in, you’ll need to enter your user ID, password, and date of birth here. You will be able to access details about your insurance and monitor the status of your coverage after you have logged in. The users should exercise due caution and/or seek independent advice before they make any decision or take any action on the basis of such information or other contents.

Here’s a complete guide on LIC home loan login procedure on the official portal of LIC HFL. Can I edit my application after it has been submitted? Yes, you can edit your application online even after submission. To do so, just follow the steps given above. Once you enter your application number, you will be given the option to edit your application.

In many cases, the bank offers a grace period during which you can clear your EMI. Following your grace period, the bank will begin charging you for late payment. You will only be added to the defaulter’s list if you miss paying your EMI for three months or 90 days. You must have noticed that the bank gives a sanction for the home loan at first and then goes forward for disbursal. However, at times, it is quite possible that your application for home loan is rejected at the last moment in spite of a sanction being issued earlier.

You will receive your login information on your registered email or mobile number. Your 830 FICO® Score is nearly perfect and will be seen as a sign of near-flawless credit management. Your likelihood of defaulting on your bills will be considered extremely low, and you can expect lenders to offer you their best deals, including the lowest-available interest rates. A 746 credit score is Very Good, but it can be even better. Mortgage financier LIC Housing Finance on Friday said it has reduced its interest rates to 6.66 per cent for home loans up to Rs 50 lakh.

LIC HFL, headquartered in Mumbai, provides long-term financing to people who want to purchase or construct a house or flats for residential purposes. You can find out the status of your LIC Housing Finance home loan either through the website or on a mobile device. The steps are easy to follow and gives you the information you need at your fingertips.

Comments

Post a Comment